The Basic Principles Of Clark Wealth Partners

Wiki Article

Rumored Buzz on Clark Wealth Partners

Table of ContentsThe Of Clark Wealth PartnersThe Basic Principles Of Clark Wealth Partners The 7-Second Trick For Clark Wealth PartnersClark Wealth Partners Can Be Fun For Anyone6 Easy Facts About Clark Wealth Partners ExplainedSome Known Facts About Clark Wealth Partners.All about Clark Wealth Partners

These are experts who provide financial investment guidance and are registered with the SEC or their state's securities regulator. NSSAs can aid elders make decisions regarding their Social Protection advantages. Financial consultants can additionally specialize, such as in pupil fundings, senior requirements, tax obligations, insurance and various other elements of your funds. The certifications needed for these specializeds can vary.Just economic consultants whose classification requires a fiduciary dutylike qualified monetary planners, for instancecan state the very same. This difference also indicates that fiduciary and financial advisor fee frameworks vary too.

Get This Report on Clark Wealth Partners

If they are fee-only, they're much more likely to be a fiduciary. Lots of qualifications and classifications require a fiduciary responsibility.

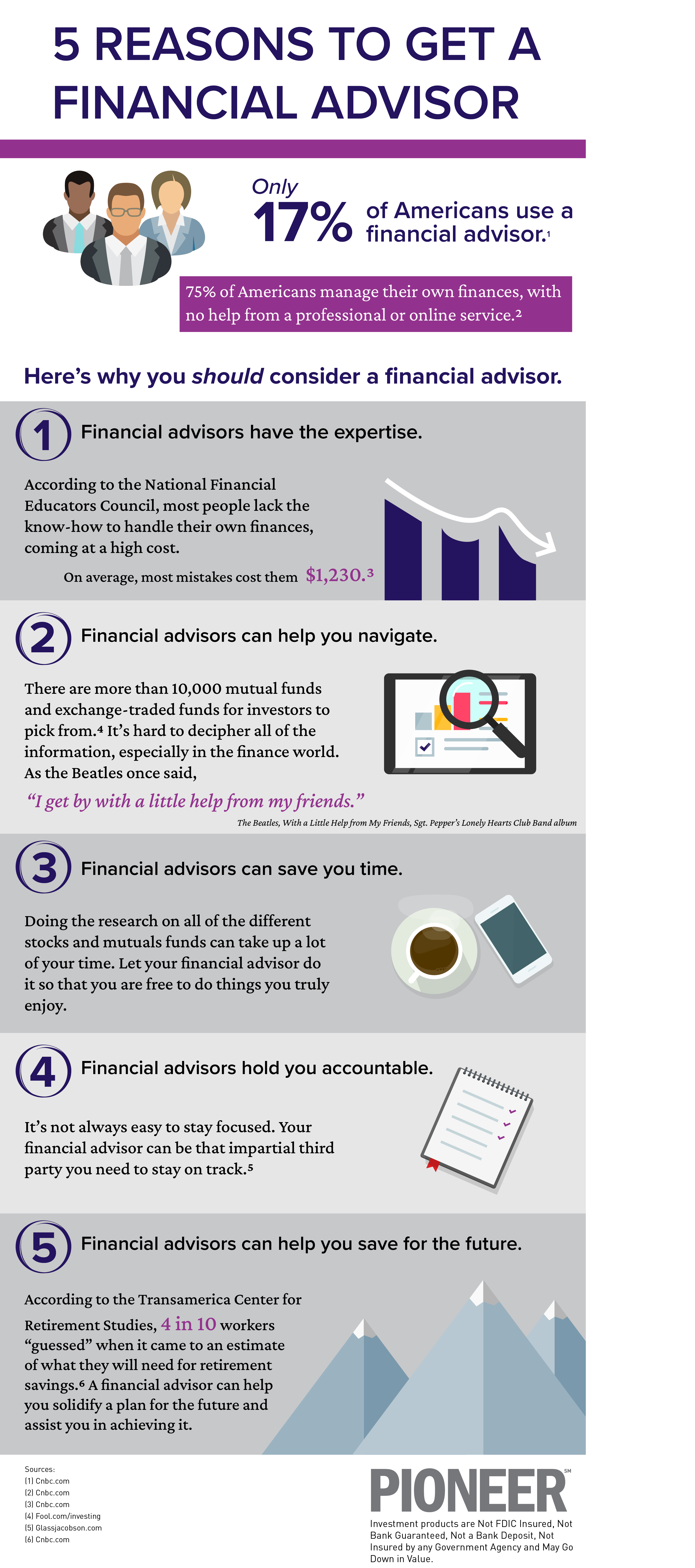

Choosing a fiduciary will certainly guarantee you aren't guided toward specific financial investments as a result of the compensation they offer - civilian retirement planning. With lots of money on the line, you may want an economic specialist who is lawfully bound to make use of those funds meticulously and only in your benefits. Non-fiduciaries may advise investment products that are best for their wallets and not your investing objectives

Our Clark Wealth Partners Ideas

Read more now on exactly how to maintain your life and savings in equilibrium. Boost in savings the ordinary household saw that dealt with a financial expert for 15 years or more compared to a similar household without a financial consultant. Resource: Claude Montmarquette & Alexandre Prud'homme, 2020. "Extra on the Value of Financial Advisors," CIRANO Project News 2020rp-04, CIRANO.

Financial recommendations can be sites helpful at transforming points in your life. When you fulfill with a consultant for the first time, function out what you want to get from the recommendations.

Clark Wealth Partners - Truths

Once you've agreed to proceed, your financial advisor will certainly prepare a financial prepare for you. This is provided to you at one more meeting in a document called a Statement of Suggestions (SOA). Ask the advisor to discuss anything you don't understand. You must always feel comfortable with your adviser and their recommendations.Firmly insist that you are alerted of all transactions, which you receive all communication pertaining to the account. Your advisor might suggest a managed optional account (MDA) as a means of handling your financial investments. This involves authorizing an agreement (MDA contract) so they can acquire or market investments without having to inspect with you.

Little Known Facts About Clark Wealth Partners.

Prior to you purchase an MDA, compare the advantages to the costs and dangers. To protect your money: Don't offer your adviser power of lawyer. Never ever sign an empty record. Put a time frame on any kind of authority you give to buy and offer investments on your behalf. Urge all correspondence regarding your investments are sent out to you, not just your consultant.If you're relocating to a new advisor, you'll need to arrange to transfer your economic documents to them. If you need assistance, ask your advisor to describe the process.

will retire over the next years. To fill their shoes, the nation will require greater than 100,000 new monetary experts to enter the sector. In their everyday work, monetary experts take care of both technical and creative tasks. United State Information and Globe Record ranked the role amongst the leading 20 Ideal Organization Jobs.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

Assisting people accomplish their economic goals is a monetary consultant's primary feature. They are additionally a little company owner, and a section of their time is committed to handling their branch office. As the leader of their method, Edward Jones economic experts need the management abilities to employ and manage team, as well as business acumen to produce and carry out a business strategy.Investing is not a "set it and forget it" task.

Financial experts must set up time every week to satisfy new individuals and catch up with individuals in their round. The financial services industry is greatly regulated, and regulations alter usually - https://www.4shared.com/u/5txrrLa9/blancarush65.html. Lots of independent financial advisors spend one to 2 hours a day on compliance tasks. Edward Jones monetary consultants are privileged the office does the heavy lifting for them.

Excitement About Clark Wealth Partners

Continuing education and learning is a needed part of keeping a financial consultant permit (financial advisors Ofallon illinois). Edward Jones monetary consultants are urged to pursue extra training to widen their expertise and abilities. Commitment to education secured Edward Jones the No. 17 place on the 2024 Educating pinnacle Honors list by Training publication. It's also an excellent concept for monetary advisors to attend market seminars.Report this wiki page